We handle all types of insurance claims

HURRICANE DAMAGE

The State of Florida is regularly exposed to hurricane incidents, so hurricane insurance is always necessary. With Fraser Public Adjusters, you can have the best team advocating for you, so you get paid exactly what you deserve.

WATER DAMAGE

Many homeowners are unaware of their water and pipe damage coverage, and assume that storm damage or flood damage is minimal or not worth claiming. At Fraser Property and Public Adjusting, your public adjuster will assess the roof damage, review your policy, and let you know your damage claims. Why should you pay for the damage with out-of-pocket money when your insurance policy covers water issues?

FIRE DAMAGE

The claim process and the Florida Laws and statutes typically provide you with all the coverage you need. While you piece your life together and build up emotional support for you and your family, we provide you with peace of mind.

You don’t have to take care of any dealing with your insurance company because we handle the whole process for the property damage.

VANDALISM DAMAGE

ROOF LEAKS

Insurance companies may try to minimize your damage or simply miss some of the damaged areas. Your Public Adjuster will work to include all of the rights you are entitled to so your roof is repaired fully and your home is protected.

FLOOD DAMAGE

The rules and regulations are different but your public adjuster at Fraser Property and Adjusting will be there for you to determine when and how to file your claim, and how to appeal if necessary.

MOLD DAMAGE

Your public adjuster at Fraser Property and Adjusting will know just how to compensate you for your damage and bring your home back to a healthy environment.

LOSS OF BUSINESS INCOME

The process is more complex than your average homeowner’s claim, and you’ll need the expertise of a Public Adjuster who specializes in commercial claims. At Fraser Property and Adjusting, we have the Florida Public Adjusters you need.

Reviewing Your Policy

Estimating Your Damages

Adjusting Your Claim

Maximizing Your Settlement

What is a Public Adjuster and How Can They Help You with Loss of Business Claims?

If you’re a Business Owner who has experienced damage to your Commercial Property and as a result have Loss of Business Income, you may be wondering what a public adjuster is and how they can assist you with your Loss of Business claim. A public adjuster is a licensed professional who works on behalf of policyholders to help navigate the insurance claims process and ensure that they receive a fair and accurate settlement for their damages. When it comes to Commercial Damage and the resulting Loss of Business Income, an Experienced Public Adjuster who specializes in Commercial Claims can help assess the extent of the damage, document the losses, and negotiate with the insurance company to maximize your claim. At Fraser Property and Adjusting we have the expertise and knowledge of Commercial Insurance Policies and regulations to advocate for your rights and ensure that you receive the compensation you deserve. By hiring a Public Adjuster from Fraser Property & Adjusting, you can have peace of mind knowing that you have dedicated professionals working on your behalf to handle all aspects of your Commercial Damage Claim, and the ensuing Loss of Business Income and help you get your losses restored.

The Benefits of Hiring a Public Adjuster for a Loss of Business Income Claim

When dealing with a Loss of Business Income to your business, the benefits of hiring a public adjuster are numerous. Business Owners know the value of their time and the expertise they possess in their unique field. Public Adjusters are specialists in the Insurance claim process work exclusively for the policyholders, and handle every aspect of the claim until a fair settlement is reached. When it comes to Commercial Claims and Loss of Business Income as a result, a specialized public adjuster can provide invaluable expertise and assistance. At Fraser Property and Adjusting we have a deep understanding of Commercial Insurance Policies and can accurately assess the extent of the damage, ensuring that all aspects are properly documented and accounted for in the claim, and work with you to properly assess the extent of your Loss of Business Income, and what you’re entitled to from your Insurance Company. Additionally, public adjusters negotiate with the insurance company on your behalf, working to maximize your settlement and ensure that you receive your fair compensation. This can alleviate the stress and frustration of dealing with the insurance company directly.

The Process of Working with a Public Adjuster for a Loss of Business Claim

When dealing with Loss of Business Income from damage to your Commercial property, working with a public adjuster greatly simplifies the process and ensures you receive fair compensation. The first step in working with a public adjuster from Fraser Property & Adjusting is to schedule an initial consultation. During this consultation, the adjuster will assess the extent of the property damage, review the procedure for claiming Loss of Business Income, and begin gathering all the necessary documentation and evidence. They will then guide you through the process of filing the claim with your insurance company, ensuring that all required forms and paperwork are completed accurately and promptly. Once the claim is filed, the adjuster will negotiate with the insurance company on your behalf, advocating for the maximum settlement amount. Throughout the entire process, the adjuster will keep you informed and provide guidance, ensuring you are well-equipped to make informed decisions about your claim. With Fraser Property & Adjusting by your side, you can have peace of mind knowing that the Loss of Business Income claim is being handled professionally and efficiently.

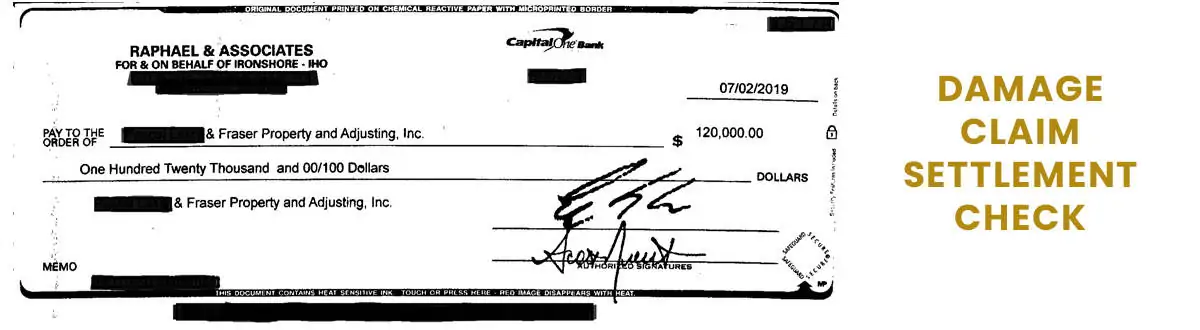

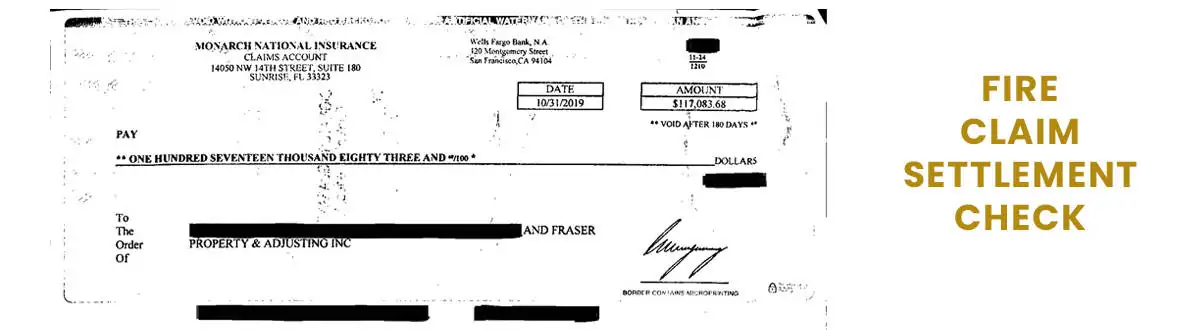

We Have Helped Our Clients Recover Millions of Dollars in Settlements

At Fraser Property & Adjusting, we take pride in our ability to help homeowners recover millions of dollars in settlements for Loss of Business Income claims. Our team of experienced Loss of Business damage claim adjusters understands the complexities of insurance policies and the intricacies of the claims process. We work diligently to gather evidence, assess the extent of the damage, and negotiate with insurance companies on behalf of our clients. Our goal is to ensure that homeowners receive fair and just compensation for their Loss of Business Income. With our expertise and dedication, we have a proven track record of success in securing substantial settlements for our clients. If you have Lost Income to Your Business due to a Commercial Insurance Claim, don’t hesitate to contact Fraser Property & Adjusting for expert assistance in navigating the claims process and maximizing your settlement.

Our Clients Results Matter The Most

A Public Adjuster or Public Insurance Adjuster is your Advocate who handles your Hurricane Insurance Claim for you and you only.

Damage Claim Settlement Check

Damage Claim Settlement Check

How to Prepare for and Recover from Potential Loss of Business Income Claim

Preparing for and recovering from a potential loss of business income claim is crucial for business owners to ensure a smooth recovery process. Here are some steps you can take:

1. Review your insurance coverage: Understand your policy and know what is covered in case of a loss of business income. Make sure your coverage is adequate and up to date.

2. Document your financial records: Keep detailed records of your business income and expenses. This will be essential when calculating your loss of income claim.

3. Create a business continuity plan: Develop a plan for how your business will continue to operate in the event of a disruption. This can include backup systems, alternative suppliers, and contingency plans.

4. Maintain proper risk management practices: Regularly assess and mitigate potential risks to your business. This can include implementing safety protocols, having a disaster recovery plan, and conducting regular maintenance on equipment and facilities.

5. Consult with professionals: Seek the expertise of a loss of business income claim adjuster, like Fraser Property & Adjusting, who can guide you through the claims process and help maximize your recovery.

Remember, being proactive and prepared can make a significant difference in how quickly and effectively your business can recover from a loss of income claim.

Tips for Protecting Your Business from Loss of Business Income

Protecting your business from a loss of business income is crucial for its survival and success. Here are some tips to help you safeguard your business:

1. Business Interruption Insurance: Purchase a comprehensive business interruption insurance policy that covers loss of income due to unforeseen events such as natural disasters, fire, or other disruptions. Make sure to review and understand the coverage limits, exclusions, and waiting periods.

2. Risk Assessment and Mitigation: Conduct a thorough risk assessment of your business operations and identify potential vulnerabilities. Take proactive measures to mitigate these risks, such as implementing backup systems, disaster recovery plans, and business continuity strategies.

3. Financial Reserves: Build up an emergency fund or financial reserves that can sustain your business during a period of income loss. This will provide a financial cushion and allow you to cover essential expenses until your business operations are back on track.

4. Diversify Your Revenue Streams: Relying on a single source of income can make your business more vulnerable to disruptions. Explore opportunities to diversify your revenue streams, such as offering additional products or services, expanding into new markets, or establishing strategic partnerships.

5. Regular Review and Update: Regularly review and update your business continuity plans, insurance coverage, and risk mitigation strategies. As your business evolves, ensure that your protective measures are aligned with any changes in your operations, industry, or external factors.

By implementing these tips, you can proactively protect your business from potential income loss and minimize the impact of unforeseen events on your operations. Remember, prevention is key to ensuring the long-term resilience and sustainability of your business.

Steps to Take After Loss of Business Income to Your Business

Experiencing a loss of business income can be a challenging and stressful situation for any business owner. However, there are steps you can take to navigate through this difficult time and ensure a smooth recovery for your business.

Firstly, it is crucial to document and gather all necessary information related to the loss. This includes financial records, receipts, invoices, and any other relevant documentation that can support your claim.

Next, notify your insurance company as soon as possible. It is important to understand the coverage and terms of your policy, as well as any specific requirements or deadlines for filing a claim.

Consider seeking the assistance of a professional loss of business income claim adjuster, such as Fraser Property & Adjusting. These experts specialize in helping business owners navigate the claims process and maximize their recovery. They can provide guidance on documenting and quantifying your loss accurately, ensuring you receive the compensation you are entitled to.

In the meantime, take proactive steps to mitigate further losses and maintain your customer base. Explore alternative sources of income, such as online sales or offering virtual services. Communicate with your customers, vendors, and employees to keep them informed about the situation and any changes to your operations.

Lastly, prioritize self-care and seek support from professionals or support groups if needed. Dealing with a loss of business income can be emotionally and mentally draining, so it is essential to take care of your well-being as you work toward recovery. Remember, with the right approach and support, you can overcome this setback and come out stronger on the other side.

Common Mistakes to Avoid When Filing a Loss of Business Income Claim

When filing a loss of business income claim, it’s important to avoid common mistakes that could potentially harm your chances of receiving a fair settlement. One common mistake is not reporting the loss promptly. It’s crucial to notify your insurance company as soon as possible after the loss occurs and provide all the necessary documentation and evidence to support your claim. Another mistake to avoid is not understanding the terms and conditions of your insurance policy. Take the time to review your policy thoroughly and seek clarification from your insurance agent if needed. Additionally, failing to document and keep detailed records of your business income and expenses can hinder the accuracy of your claim. Keep organized records of financial statements, payroll records, and any other relevant documents to support your claim. Lastly, it’s important to avoid exaggerating your losses or providing misleading information. Be honest and provide accurate information to ensure a smooth claims process. By avoiding these common mistakes, you can increase your chances of a successful loss of business income claim.

Florida Public Adjusters

Fraser Property & Adjusting Inc. is a leader in the Insurance Claims Industry and has satisfactorily recovered thousands of claims for Home and Business owners and HOAs. We strive to provide unparalleled service for our clients by addressing their needs.

EXPERT PUBLIC ADJUSTERS IN IN FLORIDA

.

Call Us Today!

(850)-542-7654

Call Us 24 Hours / 7 Days

Phone: (305)-614-2851

Address: 16375 NE 18th Avenue

Suite #201,

North Miami Beach,

FL 33162

Email: fraserproperty@gmail.com

Loss of Business Income Damage Claims FAQs

As business owners, it’s important to have a clear understanding of loss of business income damage claims and how they can impact your company. Here are some frequently asked questions about this type of claim:

What is a loss of business income claim?

A loss of business income claim is filed when a business experiences a disruption in operations due to property damage or other covered perils. It aims to compensate the business for the income lost during the period of interruption.

What types of perils are typically covered?

Common perils that may be covered include fire, water damage, natural disasters, vandalism, and theft. It’s essential to review your insurance policy to understand the specific perils covered and any exclusions.

How is the amount of loss calculated?

The calculation of loss of business income can be complex. It typically involves analyzing the business’s financial records, including revenue, expenses, and any saved expenses during the interruption. A qualified loss adjuster can help assess the financial impact accurately.

What documentation is required to support a claim?

Documentation plays a crucial role in substantiating a loss of business income claim. It’s essential to gather financial records, such as profit and loss statements, tax returns, and payroll records. Additionally, preserving any evidence of the property damage is crucial.

How long does the claims process take?

The duration of the claims process can vary depending on the complexity of the claim and the cooperation of all parties involved. It’s recommended to work with an experienced loss adjuster who can streamline the process and advocate for your interests.

Remember, every claim is unique, and it’s crucial to consult with a professional loss adjuster who specializes in loss of business income claims. They can guide you through the process, ensure proper documentation, and help maximize your claim settlement.

Put Fraser Property & Adjusting In Your Contacts Now!

In conclusion, if you are a business owner in Florida facing a loss of business income claim, it is crucial to consider hiring a public adjuster to navigate the complex process and ensure you receive the maximum compensation you deserve. Fraser Property & Adjusting is here to assist you every step of the way.

To learn more about our services and how we can help you with your loss of business income claim, complete the web form on our website or contact our team directly. Don’t let the stress of dealing with insurance companies and the intricate details of your claim overwhelm you. Reach out to Fraser Property & Adjusting and let us handle the process on your behalf.

Take action now and protect your business by seeking professional assistance. Your peace of mind and financial recovery depend on it.