Water Damage Insurance Claim Tips: How to Maximize Your Claim

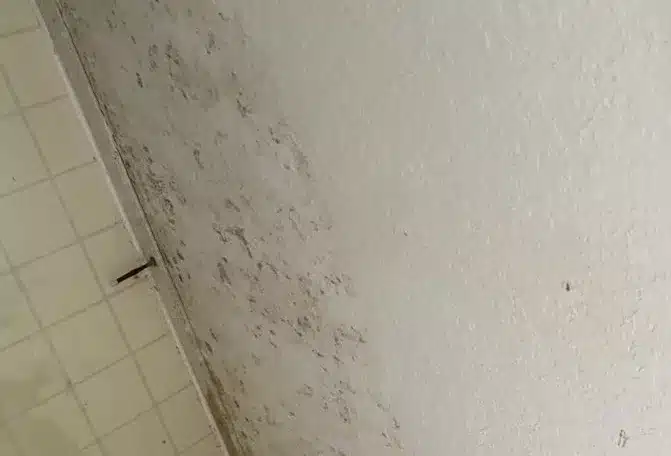

Water damage can be a homeowner’s worst nightmare. The aftermath can be devastating, from a burst pipe, a leaking roof, or a natural disaster. Filing an insurance claim is often the first step toward recovering and rebuilding in these situations. However, navigating the insurance claims process can be complex and overwhelming. That’s where a public adjuster can make a difference. This blog post will share valuable tips on maximizing your water damage insurance claim and ensuring you receive the compensation you deserve. Whether you’re dealing with minor water damage or a significant flood, these tips will help you navigate the claims process and get your life back on track.

What does water damage insurance cover?

Water damage insurance typically covers sudden and accidental water damage caused by burst pipes, leaking roofs, or plumbing issues. This can include damage to your home’s structure and personal belongings that have been affected. It is important to note that coverage may vary depending on your specific insurance policy, so it is crucial to review your policy documents and understand the terms and conditions. Some policies may also cover additional expenses, such as temporary accommodation if your home becomes uninhabitable due to water damage. To ensure you maximize your claim, it is recommended to document the damage with photographs, keep records of all communication with your insurance company, and consult with a public adjuster to navigate the claims process effectively.

How to file a water damage insurance claim?

Filing a water damage insurance claim can seem overwhelming, but with the proper steps, you can maximize your claim and ensure a smooth process. The first step is to document the damage by taking photos or videos of the affected areas. It’s essential to notify your insurance company immediately and provide them with detailed information about the incident. Be prepared to provide any necessary documentation, such as receipts for repairs or replacements. Recording conversations or correspondence with your insurance company is also a good idea. Working with a public adjuster, like Fraser Property & Adjusting, can significantly assist you in navigating the claims process. They can evaluate your policy, negotiate on your behalf, and ensure that you receive fair compensation for the damages. Remember to stay proactive and follow up with your insurance company to keep the process moving.

Best practices to maximize your water damage insurance claim

To maximize your water damage insurance claim, remember a few best practices. Firstly, it’s crucial to document the damage thoroughly. Take photos or videos of the affected areas, including any personal belongings that have been damaged. This evidence will be invaluable when filing your claim. Secondly, report the damage to your insurance company as soon as possible. Delays in reporting can lead to complications in the claims process. Additionally, keep a detailed record of any communication with your insurance company, noting dates, times, and the names of representatives you spoke with. This documentation will help ensure you have a clear record of your claim and any agreements made. Lastly, consider hiring a public adjuster who specializes in water damage claims. They have the expertise and experience to navigate the claims process and negotiate on your behalf to maximize your settlement. Following these best practices can increase your chances of receiving a fair and comprehensive settlement for your water damage insurance claim.

What to do if your insurance company denies a water damage claim?

If your insurance company denies your water damage claim, don’t panic. You can take steps to fight the denial and potentially maximize your claim. First, carefully review your policy to understand the specific coverage and exclusions of water damage. Then, gather all the evidence and documentation regarding the incident, including photos, videos, and repair estimates or invoices. It’s essential to have a detailed record of the damage and its associated costs. Next, consider hiring a public adjuster who specializes in water damage claims. They can help navigate the claims process, negotiate with the insurance company, and advocate for your rights. Additionally, you may seek legal advice from an attorney specializing in insurance claims if the denial seems unfair or unjust. Remember to stay persistent and proactive throughout the process, as insurance companies may sometimes change their decision when presented with solid evidence and arguments.