How to File a Flood Insurance Claim in 10 Easy Steps

Step 1: Assess the damage and document it thoroughly

– Take photos and videos of the affected areas

– Make a detailed list of damaged items

Step 2: Review your flood insurance policy

– Understand the coverage and exclusions

– Take note of any deadlines for filing a claim

Step 3: Notify your insurance company

– Contact your insurance agent or company to report the claim

– Provide them with the necessary information and documents

Step 4: Mitigate further damage

– Take necessary steps to prevent additional damage to your property

– Keep records of any expenses incurred for temporary repairs

Step 5: Obtain estimates for repairs

– Get multiple estimates from licensed contractors

– Provide these estimates to the insurance company for review

Step 6: Submit your claim

– Complete the necessary claim forms provided by your insurance company

– Include all relevant documentation and evidence of the damage

Step 7: Work with the insurance adjuster

– Cooperate and provide any additional information requested

– Ask for clarification if needed and negotiate a fair settlement

Step 8: Keep track of your claim

– Maintain a record of all communication with the insurance company

– Follow up regularly to ensure the progress of your claim

Step 9: Review the settlement offer

– Carefully review the settlement offer provided by the insurance company

– Seek professional advice if necessary before accepting or negotiating

Step 10: Appeal if needed

– If you believe the settlement offer is unfair, consider appealing the decision

– Provide any additional evidence or documentation to support your appeal

Remember, filing a flood insurance claim can be a complex process. Familiarizing yourself with your policy and following the steps to ensure a smooth and successful claim is essential.

How to file a flood insurance claim, and when do you file a flood claim?

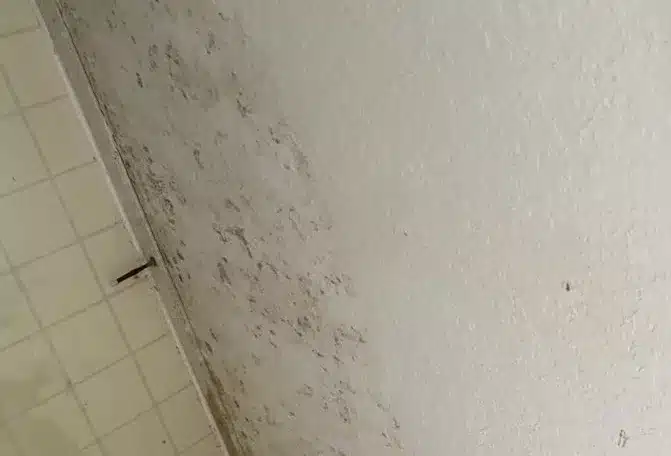

Knowing when and how to file a flood insurance claim is crucial to ensure you receive the compensation you deserve for property damage. Homeowners should file a flood claim as soon as possible after experiencing flood damage. Documenting the damage with photographs or videos before beginning any cleanup or repairs is recommended. Contact your insurance company promptly to start the claims process. Waiting too long to file a claim can result in delays or potential complications in receiving compensation for the damages caused by the flood. Be proactive and thorough in documenting the damage and initiating the claim process to ensure a smooth and timely resolution.

Work with an adjuster

How to file a flood insurance claim: When filing a flood insurance claim, working with a public adjuster is highly recommended to ensure a fair and accurate assessment of your damages. Public adjusters, like Fraser Property & Adjusting, are experts in evaluating property damage and negotiating with insurance companies on behalf of homeowners. By partnering with a public adjuster, you can increase your chances of receiving the maximum compensation you are entitled to for your flood-related losses. A public adjuster will guide you through the claims process, help document the damages, and advocate for your best interests during the settlement negotiations. Their expertise can be invaluable in ensuring you receive a fair and timely resolution to your flood insurance claim.

Document the damage and losses

How to file a flood insurance claim: When filing a flood insurance claim, it is crucial to document the damage and losses accurately. Take photos and videos of the affected areas before cleaning up or repairing. Make a detailed list of damaged items, including their descriptions, approximate age, and value. Keep all receipts related to repairs, replacements, and temporary accommodations. It is also essential to keep communication records with your insurance company, noting all conversations’ dates, times, and details. Proper documentation ensures a smooth and successful flood insurance claim process.

File a proof of loss form

How to file a flood insurance claim: When filing a flood insurance claim, one crucial step is to submit a proof of loss form to your insurance company. This form should detail the extent of the damage incurred during the flood, including a list of damaged items, their value, and any supporting documentation such as receipts or photographs. Be sure to accurately and thoroughly document all damages to ensure a smooth claims process.

Remember to submit this form within the timeframe specified by your insurance policy to avoid delays or complications in receiving the compensation you are entitled to. If you need assistance completing the proof of loss form or navigating the flood insurance claim process, consider contacting a public adjuster like Fraser Property & Adjusting for expert guidance and support.

How do flood insurance claims pay out?

When filing a flood insurance claim, homeowners often wonder how the payout process works. In general, flood insurance claims payout is based on the actual cash value (ACV) or the damaged property’s replacement cost value (RCV). Actual cash value considers depreciation, while replacement cost value covers replacing the damaged item without deducting for depreciation. The insurance adjuster will assess the damage and determine the appropriate payout based on your policy’s coverage type.

It’s essential to keep detailed records of the damage, including photos and receipts, to support your claim and ensure a fair payout. If you have any questions about the payout process, don’t hesitate to contact your public adjuster for guidance and support.

What triggers flood insurance coverage?

To trigger flood insurance coverage, it’s essential to understand what constitutes a flood according to insurance terms. A flood is a temporary condition where two or more acres of normally dry land or two or more properties are inundated by water or mudflow. This can be caused by an overflow of inland or tidal waters, a rapid accumulation of surface water, or a collapse of land along a body of water due to erosion or excessive rainfall. It’s crucial to know the specific terms of your policy and what scenarios are covered under your flood insurance to ensure you can make a successful claim when needed.

What is the definition of contents for flood insurance?

When filing a flood insurance claim, it’s crucial to understand the definition of contents in the context of flood insurance. Contents typically refer to personal property items within your home that are not part of the structure. This includes furniture, clothing, electronics, appliances, and other belongings. Documenting and inventorying all your contents accurately ensures a smooth claims process. Take photos or videos of your possessions before any damage occurs, keep receipts for high-value items, and maintain a detailed list of all items included in your claim. Documenting your content thoroughly can help streamline the claims process and ensure you receive fair compensation for your losses.

For further details, please refer to the following links:

The National Flood Insurance Program (floodsmart.gov)

Flood Insurance Overview (myfloridacfo.com)