Roofers and contractors cannot argue your claim in Florida! Know these things before submitting a roof damage claim

In Florida, roofers and contractors cannot argue your insurance claim. This is due to past issues with dishonest practices. Some would make false or exaggerated claims without homeowners’ knowledge, just to get insurance money for costly projects. “Prohibitions against deductible schemes have been in place in Florida statutes for years” (Citation, Claims Journal)

The responsibility lies with three individuals: you, a hired public adjuster, or a hired attorney. If there is a dispute, only you, a licensed public insurance adjuster, or a board-certified attorney can defend your claim.

What does this mean exactly for Florida residents filing hurricane damage claims?

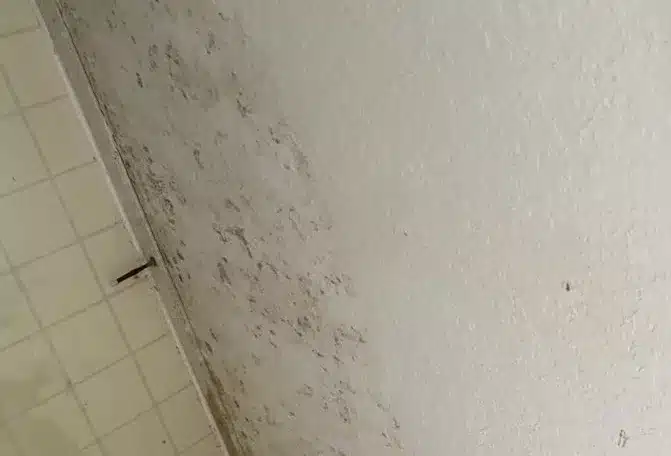

After Hurricane Ian, residents were spared the hassle of seeking quotes for repairs. Contractors took the initiative and provided estimates for homeowners to submit their claims. From roof damage claims, flood damage claims, and other storm and water damage claims. In the aftermath of damage. Some insurance companies will ask for quotes.

While there’s nothing inherently wrong with accepting a contractor’s bid, there are important things to note. You accept a certain level of responsibility when you submit that bid with your damage claim to your insurance company – and it’s important you understand that responsibility and what it is that you’re putting yourself on the line for.

Just like not knowing the speed limit won’t get you out of a speeding ticket, neither will not knowing the true cost to repair your damage prevent you from getting denied by an insurance company that doesn’t agree with the charges. Insurance companies have tens of thousands of cases to compare actual damage and actual costs against. When they see a claim come in that appears wildly out of line with their data, they can be quick to deny the claim or to counter with the lowest figure on their data chart.

We’re not implying that your contractor is unethical – not at all. It’s not uncommon or unscrupulous for a contractor to put together an estimate of the cost of repairs without looking through the eyes of the “principle of indemnity” i.e. your policy, state statutes (626.9744 (1), (2) for example) case law, etc. It’s that it’s outside the scope of their job to factor all of those details in when bidding for your job.

When you submit a bid, you’re stating that you understand, agree to, and stand behind it as an accurate cost. Insurance companies know that homeowners may not know the true cost of repairs. However, by submitting your claim, you’re still attesting that you do.

What a public adjuster does

When you hire a public adjuster, like at Fraser Property and Adjusting, you’re shifting the burden. We prepare your claim in the insurance company’s language and negotiate on your behalf. FPA assembles the bid and engages in discussions with the insurer to meet their requirements.

A lot of people don’t realize that there is no upfront cost whatsoever to have a public adjuster do this for you. A public adjuster doesn’t get paid unless your claim is approved by the insurance company. And if approved, a public adjuster doesn’t get paid UNTIL your claim is paid. On average, people who use a public adjuster tend to receive higher claims amount payouts than those who do not because of their understanding of the regulations and laws.

Both an insurance adjuster and an attorney can be of service after a claim is denied. An insurance adjuster can be brought in before the claim is submitted to participate in the entire process from filing to settlement.

Special cases division for Hurricane Ian Damage Claim Victims

If you’re confused about the process, that’s understandable. Aryeh, Ms. Maude, Abraham, Sharon, and David – we are South Florida public insurance adjusters serving our community. We have set up a special division to provide information, answer questions, and assist you in navigating the hurricane insurance claims process.

Sarasota Hurricane Ian Headlines:

Home damage from Ian exceeds $33M in unincorporated Sarasota County, according to initial report