Is it too Late to File Your Hurricane Ian Claim?

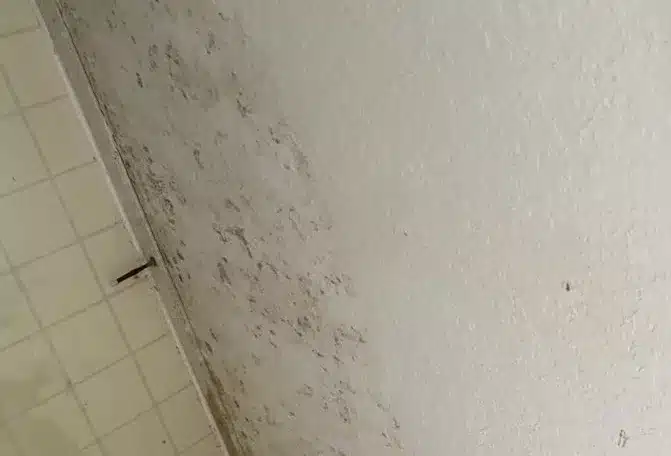

Hurricane Ian has caused a lot of damage and destruction, leaving many homeowners in Florida wondering if it’s too late to file their insurance claims. After a hurricane, it can be overwhelming to focus on safety and immediate needs. However, homeowners should know they still have time to file their claims and get the compensation they deserve. In this blog post, we will explore the timeline for filing hurricane claims, the steps involved, and how Fraser Property & Adjusting can assist homeowners in navigating the process. Don’t miss out on the opportunity to get the support you need – continue reading to find out if it’s too late to file your Hurricane Ian Insurance claim.

Don’t Miss out on your Hurricane Ian Insurance Claim

As a homeowner who has suffered damage from Hurricane Ian, you must file your insurance claim as soon as possible. Many homeowners mistakenly believe a specific time limit exists for filing a claim. Still, in Florida, the statute of limitations for filing a hurricane insurance claim was typically three years and has been modified numerous times. That means you may still have time to submit your claim and receive the compensation you deserve for the damages incurred by contacting a reputable public adjuster such as Fraser Property & Adjusting. Remember, the earlier you file your Hurricane Ian insurance claim, the better your chances of receiving the compensation you need to repair your home.

Hurricane Ian Claim Denied, Delayed, or Underpaid

If you’ve faced difficulties with your Hurricane Ian insurance claim, such as denial, delay, or underpayment, don’t worry. You still have options to receive the compensation you deserve. Many homeowners encounter obstacles when dealing with insurance companies after a hurricane; however, it’s crucial to remember that you have certain rights as a policyholder. First, examine your insurance policy to understand the coverage and claim procedure. Then, gather all the required documentation, such as photos, receipts, and damaged item inventories. Suppose the Insurance Company has denied, delayed, or underpaid your claim. In that case, consider hiring a public adjuster, such as Fraser Property & Adjusting, who can negotiate with insurance companies on your behalf to guarantee that you receive a fair settlement. Remember, you may still have time to fight for the compensation you’re entitled to for your Hurricane Ian Insurance claim.

Don’t Handle the Appeal Yourself

If you need to file an appeal for your claim related to Hurricane Ian, it’s best to avoid handling it yourself. Dealing with insurance companies and navigating the appeal process can be overwhelming and complex. Public adjusters, like Fraser Property & Adjusting, can help you maximize your claim settlements. They have the knowledge and expertise to review your policy, assess damages, and negotiate with the insurance company on your behalf. Hiring a public adjuster ensures handling your appeal professionally and effectively, increasing your chances of a successful outcome. Don’t let the stress of the appeal process discourage you from pursuing the settlement you deserve. Please leave it to the experts to handle it for you.